One of the first steps to reviving your credit score is to understand what factors contribute to it. Your payment history, credit utilization ratio, credit history length, types of credit, and new credit inquiries are just a few of the variables that affect your credit score. By knowing how each of these factors affects your score, you can develop a strategic plan to improve it.

Payment history

Start by focusing on your payment history. Payment history accounts for about 35% of your credit score, making it one of the most significant factors. Make sure to pay all of your bills on time, including credit card payments, loan installments, and utility bills. Late payments can have a detrimental impact on your credit score, so it’s crucial to prioritize timely payments.

Another factor that heavily influences your credit score is your credit utilization ratio. This ratio compares your total credit card balances to your total credit limits. Ideally, you should aim to keep your credit utilization below 30%. If your balances are consistently high, it may be beneficial to develop a plan to pay them down. Consider creating a budget, cutting unnecessary expenses, and allocating extra funds towards reducing your credit card debt.

Credit history

The length of your credit history also plays a role in determining your credit score. Lenders prefer borrowers with a longer credit history, as it provides them with a more comprehensive view of your financial habits. If you’re new to credit or have a limited credit history, consider opening a secured credit card or becoming an authorized user on someone else’s credit card. These strategies can help you establish a positive credit history over time.

Furthermore, having a diverse mix of credit types can positively impact your credit score. Lenders like to see that you can handle different types of credit responsibly. This can include credit cards, loans, mortgages, and even store credit accounts. However, it’s important to note that you shouldn’t open new credit accounts just for the sake of diversification. Only take on new credit if you genuinely need it and can manage it responsibly.

Credit inquiries

Lastly, be mindful of new credit inquiries. Every time you apply for new credit, such as a loan or credit card, a hard inquiry is placed on your credit report. Multiple hard inquiries within a short period can raise red flags for lenders and potentially lower your credit score. Therefore, it’s wise to limit your credit applications and only apply for credit when necessary.

Reviving your credit score takes time and effort, but with dedication and discipline, it is possible. By understanding the factors that contribute to your credit score and implementing smart financial habits, you can breathe new life into your credit and set yourself up for a brighter financial future.

Understanding Your Credit Score

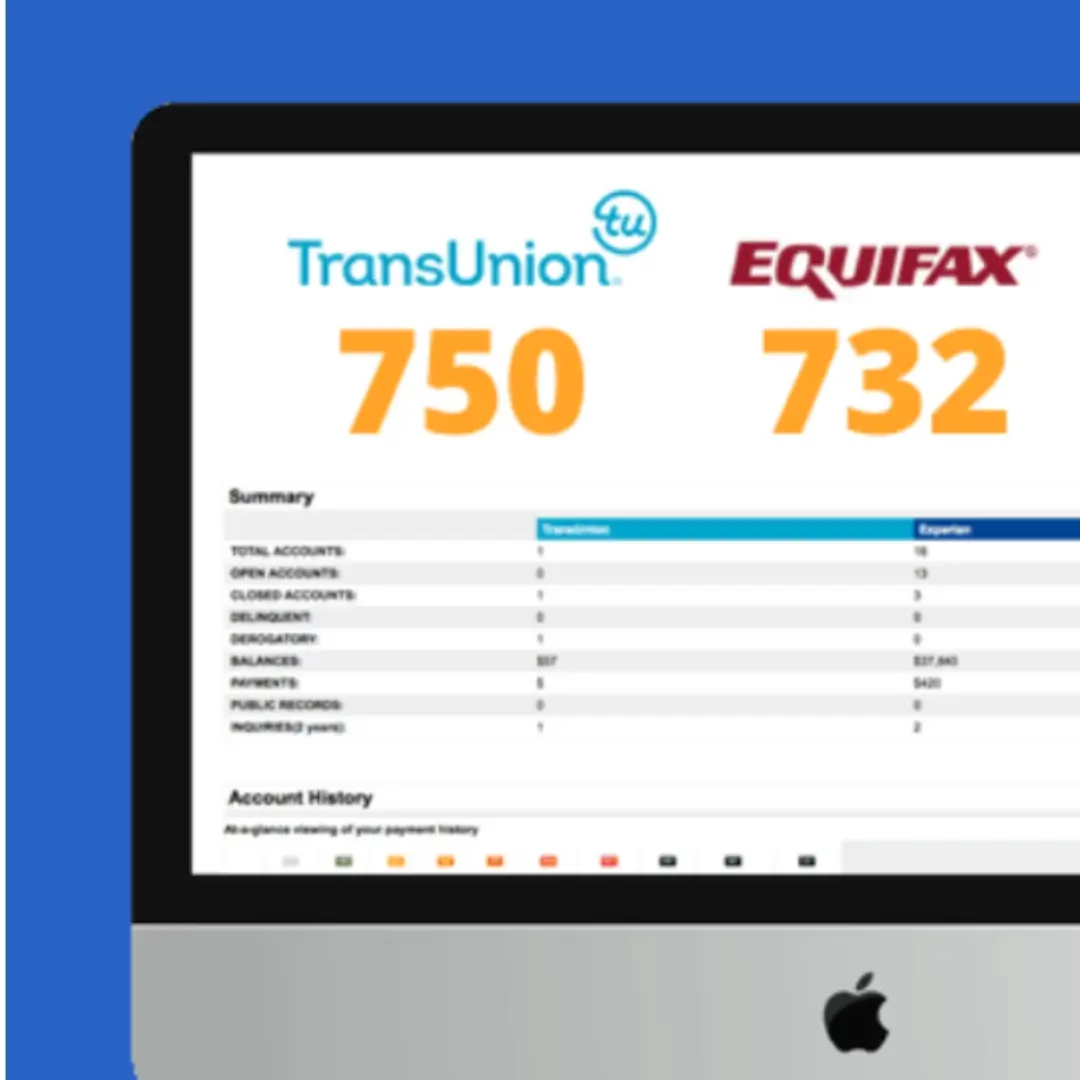

Before we dive into the tips and strategies for credit repair, it’s important to understand what a credit score is and how it is calculated. Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. The higher your score, the more likely you are to be approved for credit and receive favorable interest rates.

Several factors influence your credit score, including:

- Payment history: This is one of the most important factors that lenders consider when evaluating your creditworthiness. It shows how responsible you have been in making your payments on time. Late or missed payments can have a negative impact on your credit score.

- Amount owed: This factor takes into account your credit utilization, which is the percentage of your available credit that you are currently using. It’s important to keep your credit card balances low and avoid maxing out your credit limits, as it can indicate financial instability.

- Length of credit history: The length of your credit history also plays a role in determining your credit score. Lenders prefer to see a longer credit history, as it provides them with more information about your financial behavior. If you are just starting to build credit, it’s important to establish a positive credit history as early as possible.

- New credit: Opening multiple new credit accounts within a short period of time can raise concerns for lenders. It may indicate that you are in financial distress or are taking on too much debt. It’s advisable to only apply for new credit when necessary and to space out your applications.

- Credit mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It shows that you can handle different types of credit responsibly.

By focusing on these factors, you can take steps to improve your credit score and revive your financial health. Understanding how each factor contributes to your credit score allows you to make informed decisions about your financial habits and take actions that will have a positive impact on your creditworthiness.

Tips for Credit Repair

1. Check Your Credit Report regularly

The first step in credit repair is to obtain a copy of your credit report from the major credit bureaus. Review the report carefully for any errors or discrepancies. If you find any inaccuracies, dispute them with the credit bureau to have them corrected. Regularly monitoring your credit report allows you to stay on top of any changes and address any issues promptly.

2. Pay Your Bills on time

Payment history is a significant factor in determining your credit score. Late payments can have a negative impact on your score. Make it a priority to pay your bills on time, including credit card payments, loan installments, and utility bills. Setting up automatic payments or reminders can help ensure you never miss a due date.

3. Reduce Your Debt

The amount owed on your credit accounts, also known as credit utilization, is another crucial factor in your credit score. Aim to keep your credit utilization ratio below 30%. Paying down your debt and avoiding maxing out your credit cards can significantly improve your credit score over time.

4. Avoid Opening Multiple New Credit Accounts

While it may be tempting to open new credit accounts to improve your credit mix, it’s important to do so cautiously. Opening multiple new accounts within a short period of time can raise red flags for lenders and negatively impact your credit score. Instead, focus on managing your existing credit accounts responsibly.

5. Be patient and persistent

Improving your credit score takes time and effort. It’s essential to be patient and persistent in your credit repair journey. Consistently practicing good credit habits, such as paying your bills on time and reducing your debt, will gradually improve your credit score and set you on the path to financial success.

6. Consider credit counseling

If you’re struggling with managing your credit or finding it challenging to improve your credit score on your own, consider seeking credit counseling. Credit counseling agencies can provide guidance and support in developing a personalized plan to address your credit issues. They can help you create a budget, negotiate with creditors, and educate you on credit management strategies.

7. Avoid credit repair scams

Be cautious of companies or individuals promising quick fixes to your credit problems for a fee. Many credit repair scams exist, and they often make false claims or use illegal tactics to try to improve your credit score. It’s essential to do thorough research and verify the credibility of any credit repair service before engaging with them.

8. Build a Positive Credit History

In addition to repairing your credit, it’s crucial to build a positive credit history. This can be done by responsibly using credit cards, making regular payments, and keeping your credit utilization low. Building a solid credit history over time will demonstrate your creditworthiness to lenders and improve your overall credit score.

9. Seek professional help if needed

If you’re overwhelmed or unsure about how to proceed with credit repair, don’t hesitate to seek professional help. Credit repair professionals, such as credit attorneys or reputable credit repair companies, can provide expert guidance and assistance in navigating the complexities of credit repair. They can help you understand your rights, handle disputes, and develop a comprehensive credit repair strategy.

10. Stay Committed to Financial Responsibility:

Ultimately, credit repair is not a one-time fix but a long-term commitment to financial responsibility. It’s essential to continue practicing good credit habits even after you’ve improved your credit score. This includes regularly checking your credit report, paying your bills on time, and managing your debt responsibly. By staying committed to financial responsibility, you can maintain a healthy credit score and achieve your financial goals.

Building a Savings Safety Net

While repairing your credit score is crucial, it’s equally important to establish a robust savings safety net. Life is full of unexpected events, and having savings can provide a financial cushion in times of emergencies or unforeseen expenses.

1. Creating a savings plan

Creating a savings safety net involves setting aside a portion of your income regularly. Start by determining how much you can comfortably save each month. Consider your income, expenses, and financial goals. It’s generally recommended to save at least three to six months’ worth of living expenses, but the exact amount may vary depending on your circumstances.

2. Build your savings

One effective way to build your savings is by automating the process. Set up an automatic transfer from your checking account to your savings account on each payday. This way, you won’t have to rely on willpower alone to save; it becomes a habit. Treat your savings as a non-negotiable expense, just like paying your bills.

3. Reduce spending

Another strategy is to cut back on unnecessary expenses. Take a close look at your budget and identify areas where you can reduce spending. It could be as simple as cutting back on eating out or finding more affordable alternatives for your daily habits. Small sacrifices can add up over time and contribute significantly to your savings.

4. Maximize your earnings

Consider exploring different savings options to maximize your earnings. Traditional savings accounts offer a safe place to store your money, but the interest rates are often low. Research high-yield savings accounts or certificates of deposit (CDs) that offer better returns. These accounts may have certain restrictions, such as minimum balance requirements or withdrawal penalties, so be sure to understand the terms before committing.

In addition to traditional savings accounts, you may also consider investing a portion of your savings in low-risk options such as bonds or index funds. While these investments carry some level of risk, they have the potential for higher returns compared to regular savings accounts. However, it’s essential to do thorough research or consult with a financial advisor before venturing into investment options.

5. Prioritizing savings

Building a savings safety net requires discipline and patience. It may take time to accumulate the desired amount, but every small step counts. Remember to regularly review and adjust your savings goals as your financial situation evolves. By prioritizing savings, you’ll be better equipped to handle unexpected expenses and have peace of mind knowing you have a financial cushion to fall back on.

6. Reduce Your Debt

One of the most effective ways to save money is to reduce your debt. High-interest debt, such as credit card debt, can eat away at your savings and make it difficult to achieve your financial goals. Create a plan to pay off your debts by prioritizing high-interest debts first and making extra payments whenever possible. As you pay off your debts, you’ll free up more money to put towards savings.

7. Shop Smart

When it comes to saving money on everyday purchases, it’s important to be a smart shopper. Comparison shop for big-ticket items and take advantage of sales and discounts. Use coupons and loyalty programs to save money on groceries and household items. Additionally, consider buying in bulk for items you use frequently to save money in the long run.

8. Cook at Home

Eating out can be expensive, so try to cook at home as much as possible. Plan your meals in advance, make a grocery list, and stick to it. By cooking at home, you’ll not only save money but also have more control over the ingredients and portion sizes, leading to healthier eating habits.

9. Save on Utilities

Reducing your utility bills can significantly impact your monthly expenses. Take steps to conserve energy by turning off lights when not in use, adjusting your thermostat, and using energy-efficient appliances. Consider installing a programmable thermostat to automatically adjust the temperature when you’re not at home. Additionally, compare utility providers to ensure you’re getting the best rates.

10. Prioritize quality over quantity

When it comes to making purchases, it’s important to prioritize quality over quantity. Investing in high-quality, durable items may cost more upfront,but it can save you money in the long run. Cheap, low-quality products often need to be replaced more frequently, leading to additional expenses over time.

By implementing these tips for saving money, you’ll be well on your way to achieving your financial goals and building a solid foundation for your future.

Disclaimer: While credit repair can have a positive impact on your credit score and financial health, it is important to note that results may vary. Credit Solutions.AI® cannot guarantee specific outcomes, as each individual’s credit situation is unique