If you want to be financially successful but have a poor credit score, you must start investing in credit repair. It affects the interest rates you pay on loans and credit cards and sometimes decides whether you can get them at all. Over...

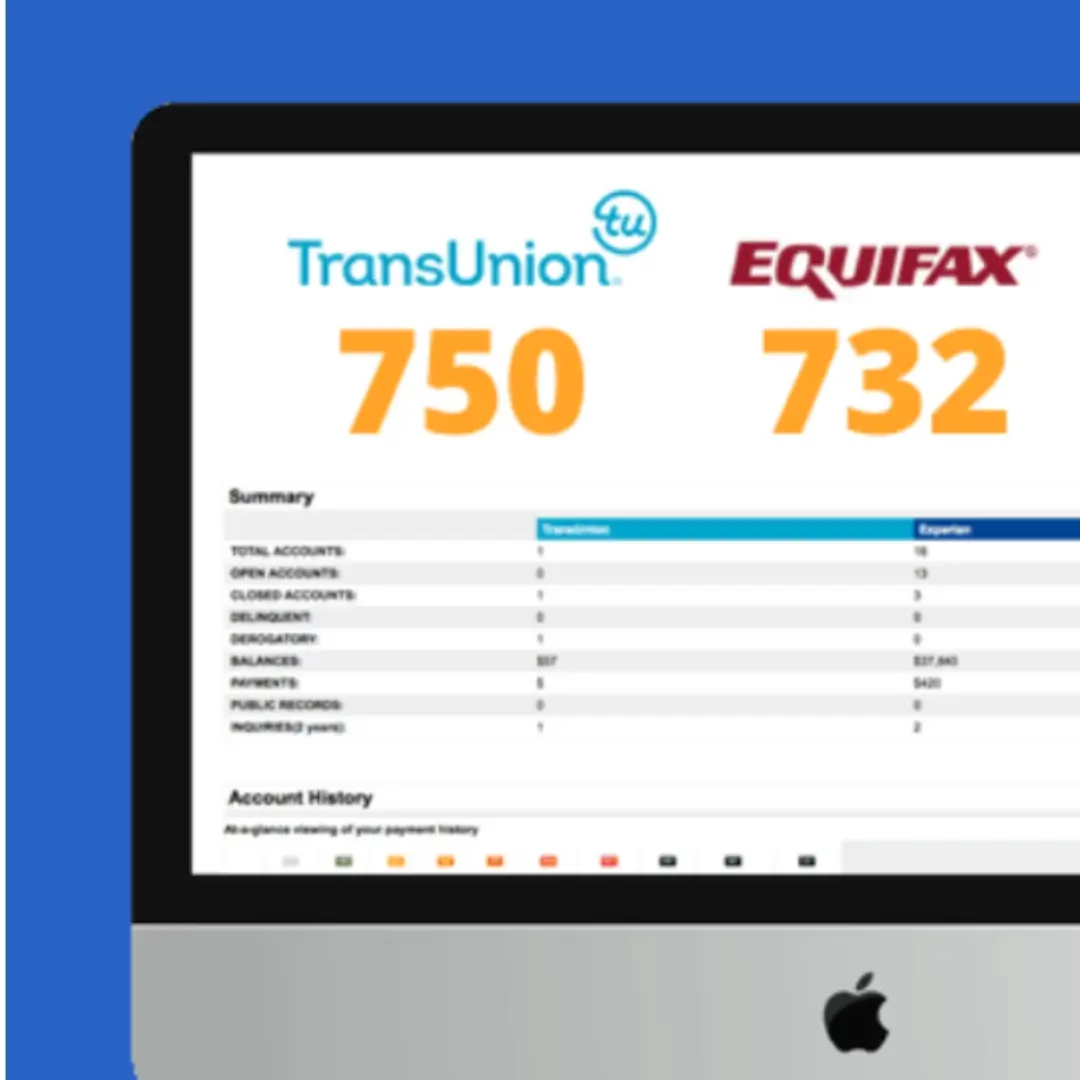

One step on the path to financial freedom is to understand the significance of a good credit score. Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role in determining whether lenders will approve your loan applications...

One of the most effective travel hacks for building credit is to strategically use travel reward credit cards. These cards allow you to earn points or miles for every dollar you spend on travel-related expenses, such as flights, hotels, and rental cars. By...

One of the key factors contributing to the fear of financial insecurity is a lack of understanding about credit and how it works. Many people are unaware of the importance of credit confidence in their financial lives and the impact it can have...

When it comes to balancing debt, finding the right balance between debt repayment and credit repair can be a challenging task. On one hand, you want to eliminate your debt and improve your credit score, but on the other hand, you also need...

Financial empowerment is crucial for individuals to achieve long-term success and stability. Repairing credit and developing savings habits are two pillars of financial empowerment. Learning and utilizing these strategies may improve financial problems and put people up for success. This blog post will...

Building and strengthening your credit health is essential in today’s financial landscape. Your credit score not only determines your eligibility for loans and credit cards, but it also plays a significant role in determining the interest rates you will be offered. A higher...

One of the first steps to reviving your credit score is to understand what factors contribute to it. Your payment history, credit utilization ratio, credit history length, types of credit, and new credit inquiries are just a few of the variables that affect...

Welcome to “From Debt to Wealth: Transforming Your Financial Story with Credit Repair and Saving Tips”! In this blog post, we will explore the journey of breaking free from debt and setting yourself on a path towards wealth accumulation. By implementing expert credit...

The Importance of Financial Wellness Financial wellness is a crucial aspect of our lives that affects our overall well-being and peace of mind. When we have control over our finances and are on the path to financial stability, we can reduce stress, achieve...