Improve Credit Score

One of the most effective ways to improve credit score is to make timely payments on all your debts and credit cards. Your credit score plays a crucial role in your financial health. It determines your ability to secure loans, rent an apartment, and even get a job. If you have a low credit score, don’t worry! There are several strategies you can implement today to start boosting your credit score and improving your financial prospects.

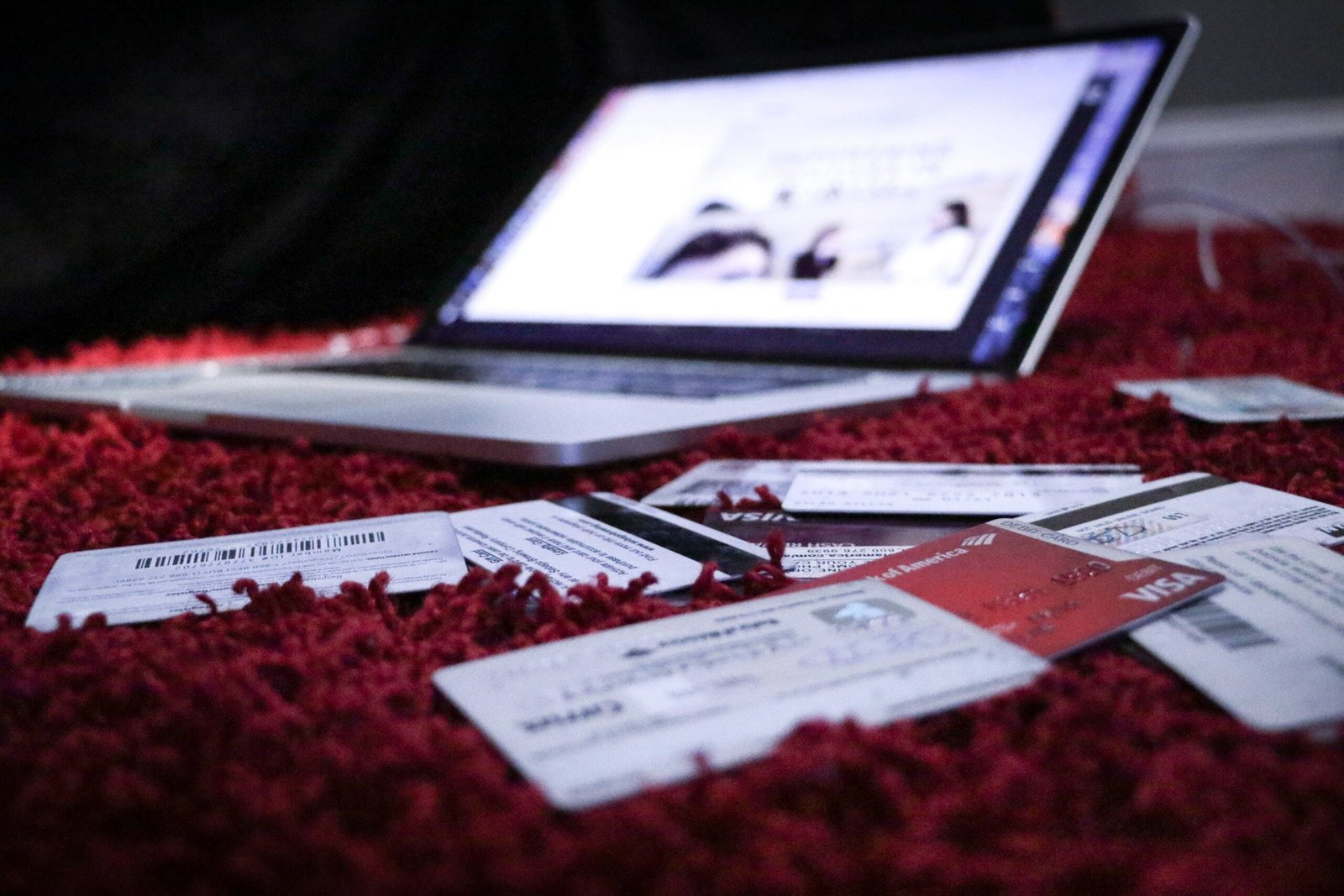

![]() Consulting a credit counselor is like seeing a GPS when you’re lost. Sure, you might eventually find your way, but wouldn’t you rather not drive in circles?

Consulting a credit counselor is like seeing a GPS when you’re lost. Sure, you might eventually find your way, but wouldn’t you rather not drive in circles?

In this article, we will discuss five effective strategies that can help you achieve a higher credit score.

1. Pay Your Bills on Time

One of the most important factors that influences your credit score is your payment history. Late payments can have a significant negative impact on your score. Make it a priority to pay all your bills on time, including credit card payments, utility bills, and loan installments. Set up automatic payments or create reminders to ensure you never miss a due date.

2. Reduce Your Credit Card Balances

Your credit utilization ratio, which is the amount of credit you are using compared to your total credit limit, also affects your credit score. Aim to keep your credit utilization below 30% to demonstrate responsible credit management. If your balances are currently high, develop a plan to pay them down. Consider paying more than the minimum payment each month or transferring balances to a card with a lower interest rate.

3. Check Your Credit Report Regularly

Mistakes on your credit report can negatively impact your credit score. Regularly review your credit report to ensure all the information is accurate and up-to-date. Look for any errors, such as incorrect personal information or accounts that don’t belong to you. If you find any discrepancies, file a dispute with the credit bureaus to have them corrected.

4. Diversify Your Credit Mix

Having a healthy mix of credit accounts can positively impact your credit score. Consider diversifying your credit mix by applying for different types of credit, such as a mortgage, car loan, or credit card. However, be cautious and only take on credit that you can manage responsibly. Applying for too much credit within a short period of time can have a negative impact on your score.

5. Avoid Closing Old Credit Accounts

While it may be tempting to close old credit accounts that you no longer use, doing so can actually harm your credit score. The length of your credit history is an important factor in determining your score. Keep your oldest credit accounts open, even if you don’t actively use them, to maintain a longer credit history. However, it’s important to keep an eye on these accounts and ensure they remain in good standing.

Conclusion

Improving your credit score is not an overnight process, but by implementing these five strategies, you can start on the path to a better credit score today. Remember to pay your bills on time, reduce your credit card balances, regularly check your credit report, diversify your credit mix, and avoid closing old credit accounts. With time and responsible financial management, you can boost your credit score and enhance your financial prospects.

Disclaimer: While credit repair can have a positive impact on your credit score and financial health, it is important to note that results may vary. Credit Solutions.AI® cannot guarantee specific outcomes, as each individual’s credit situation is unique.